THE #1 BUSINESS FUNDING SOLUTION

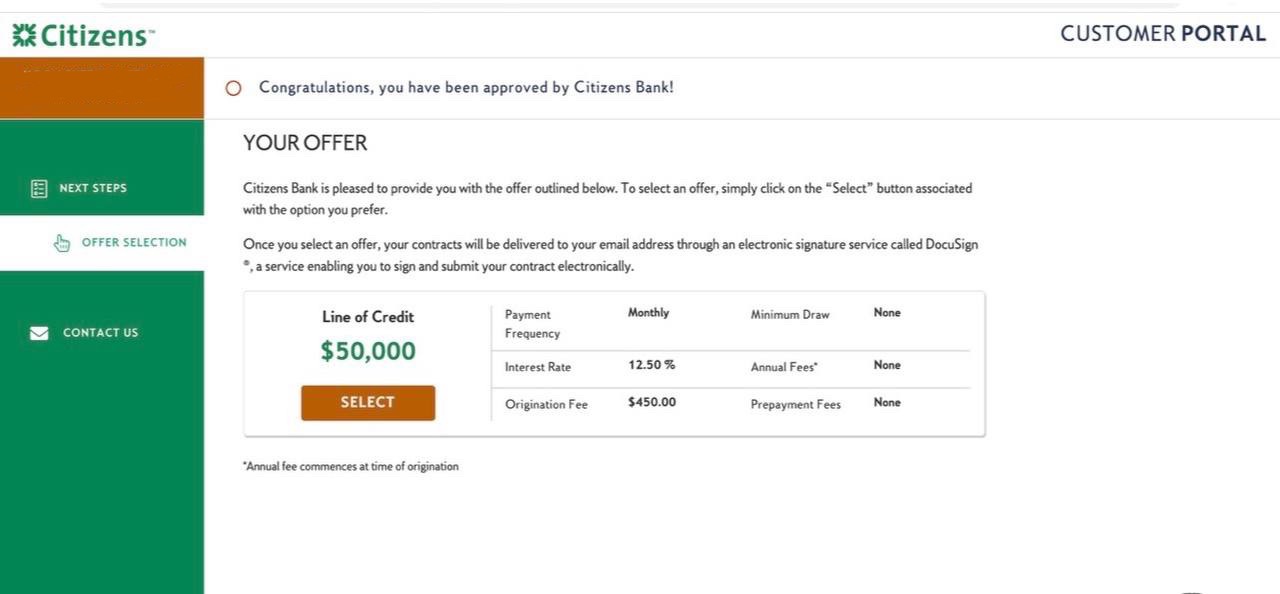

From Denials to Approvals: The Masterclass That Shows You How to Get $50K to $250K in Business Funding Step-by-Step.

Sale ends in

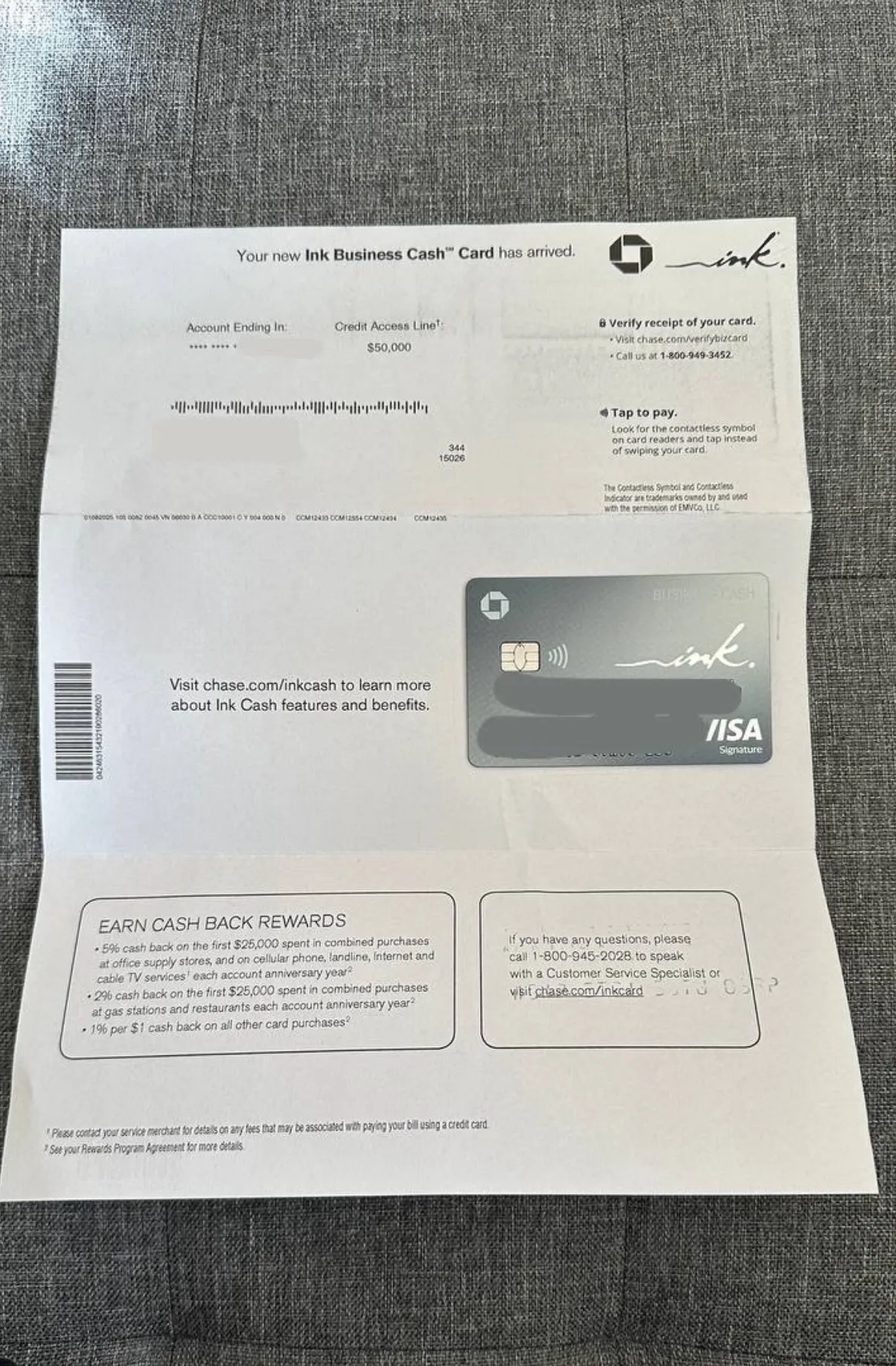

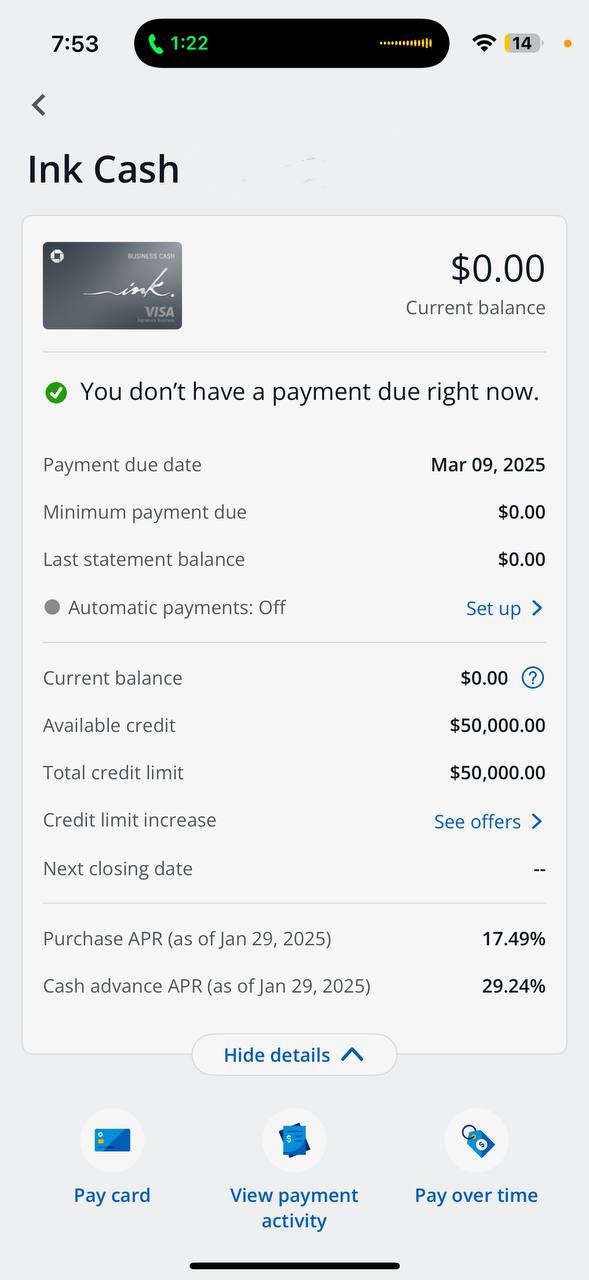

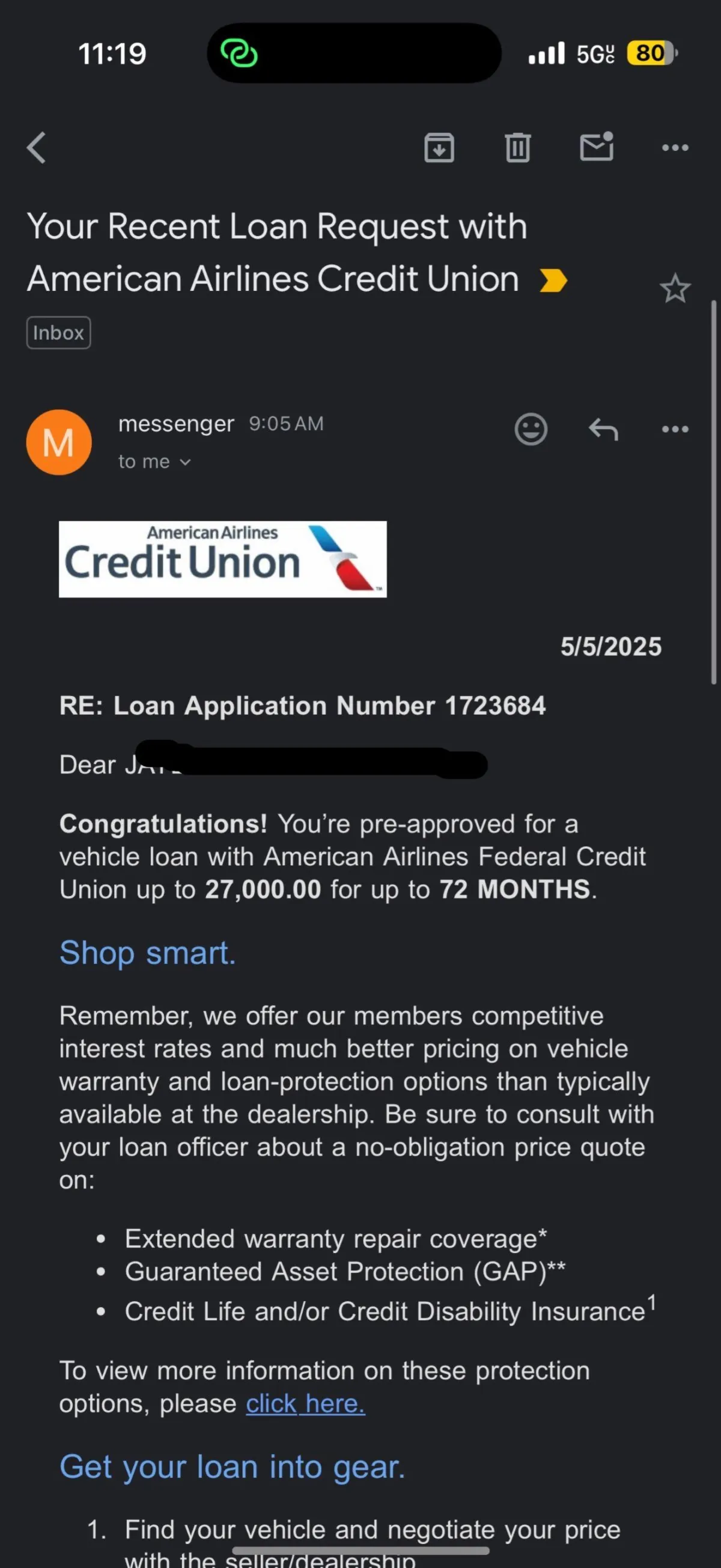

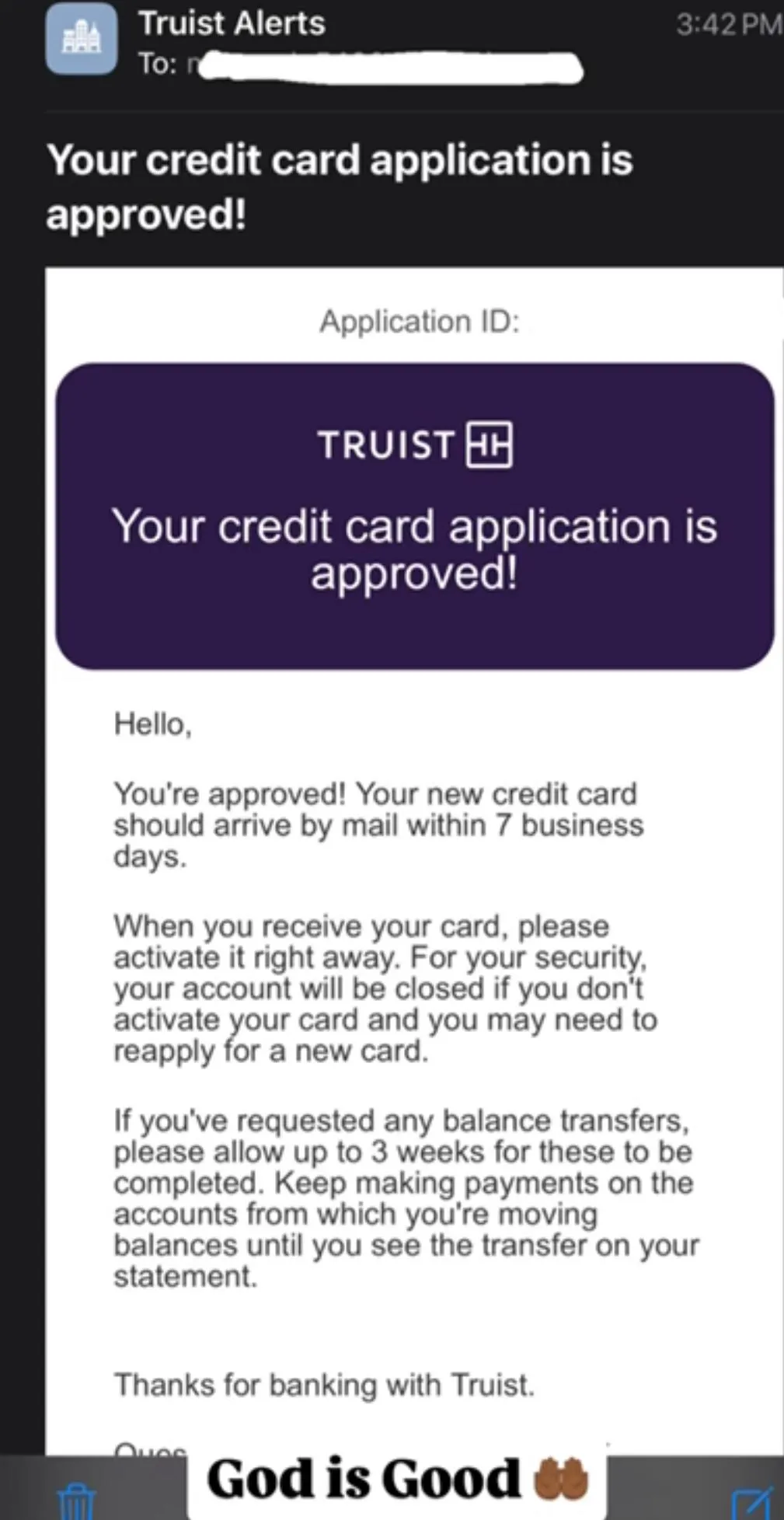

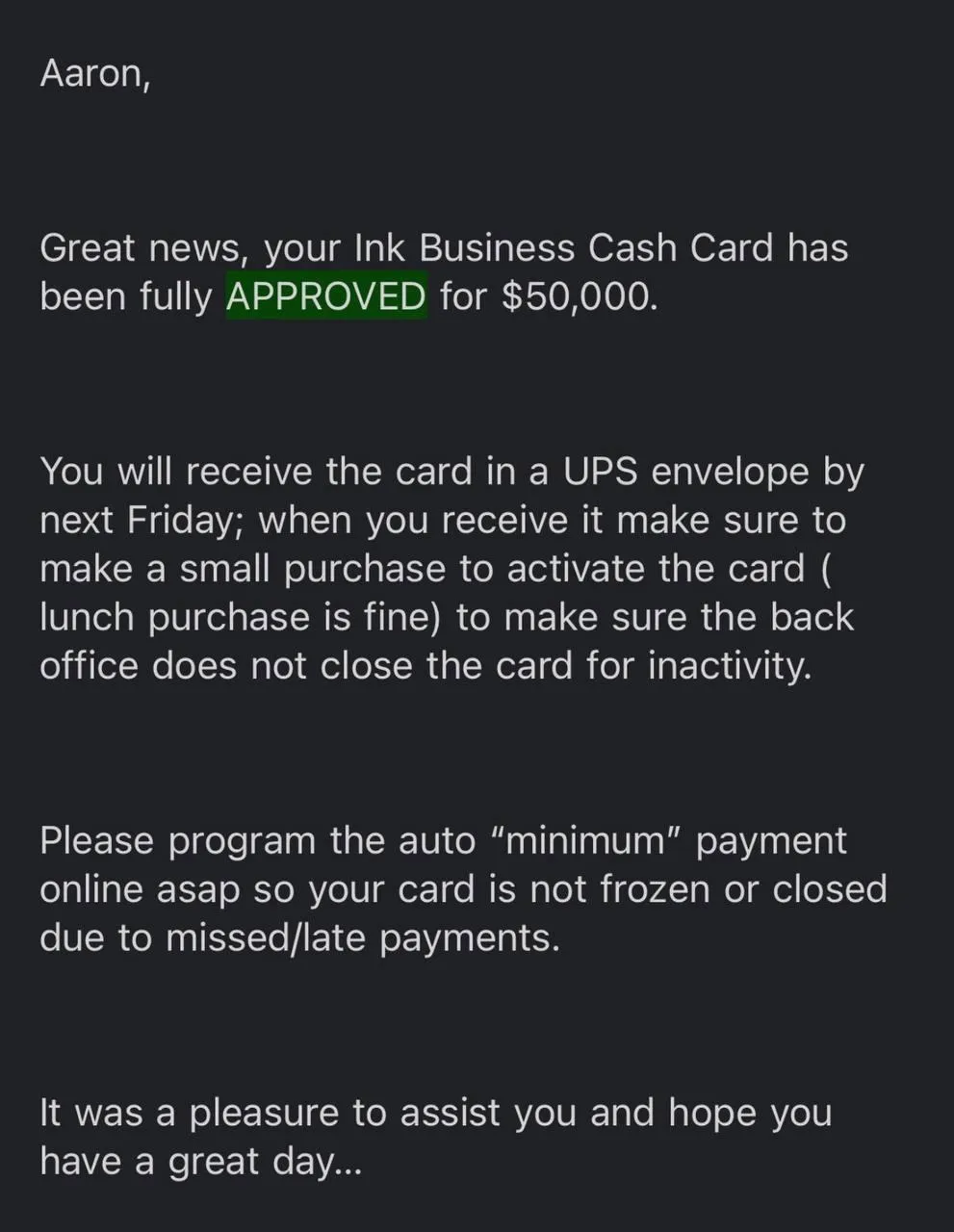

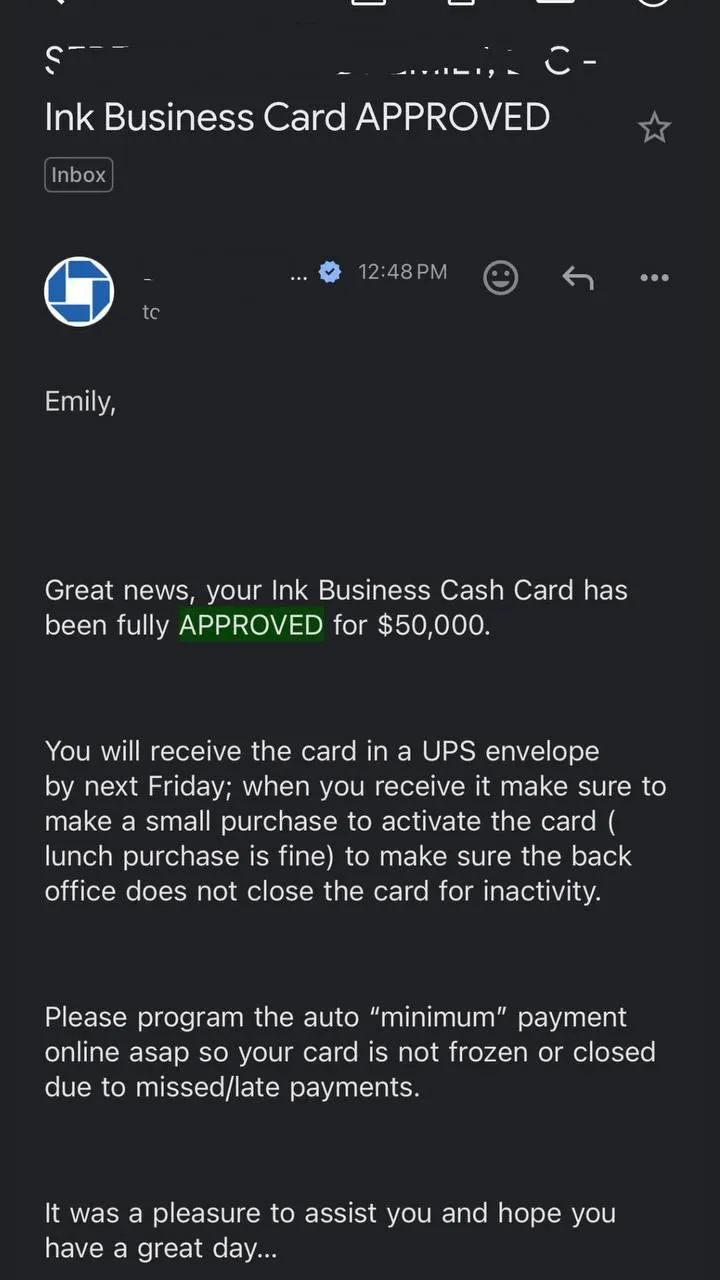

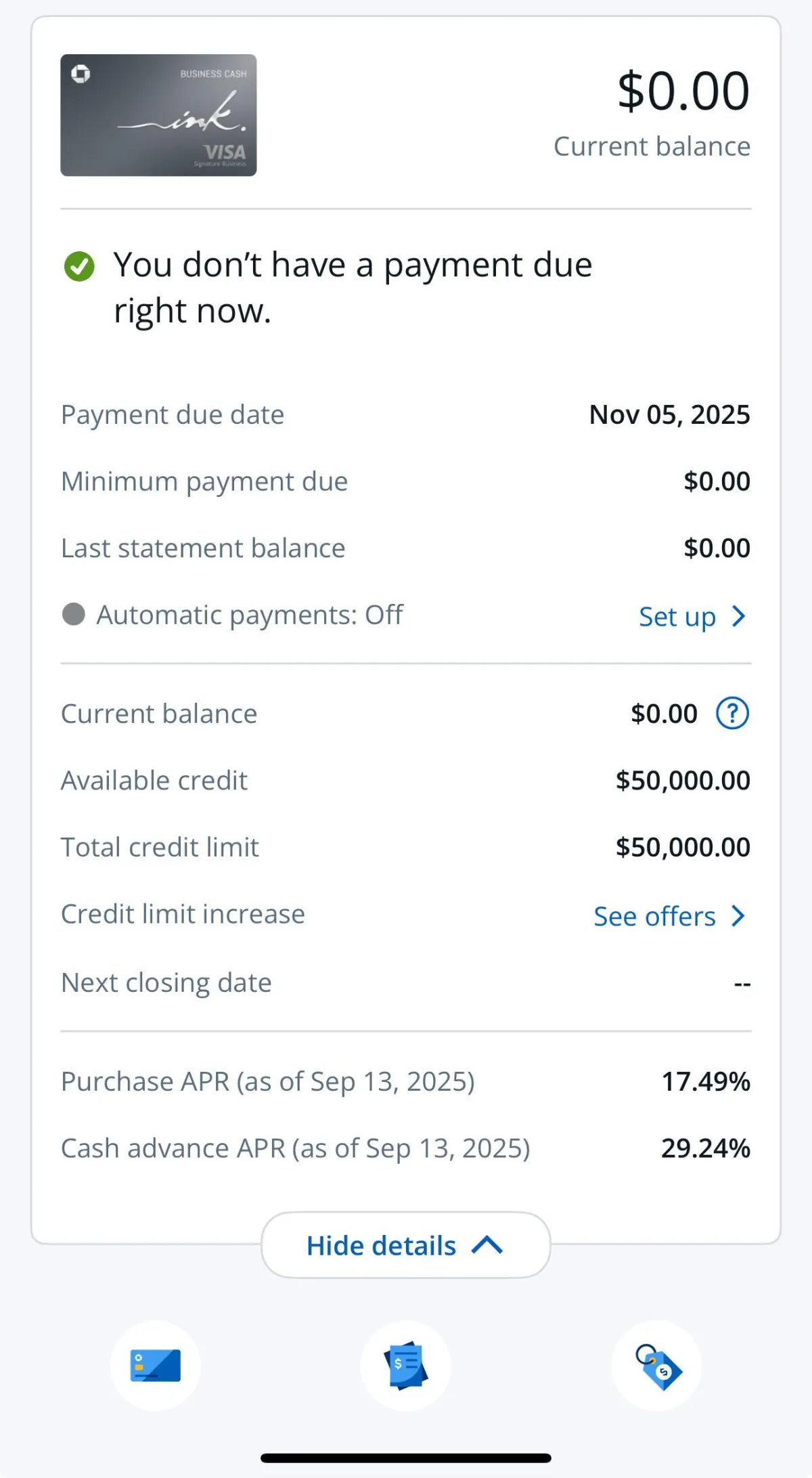

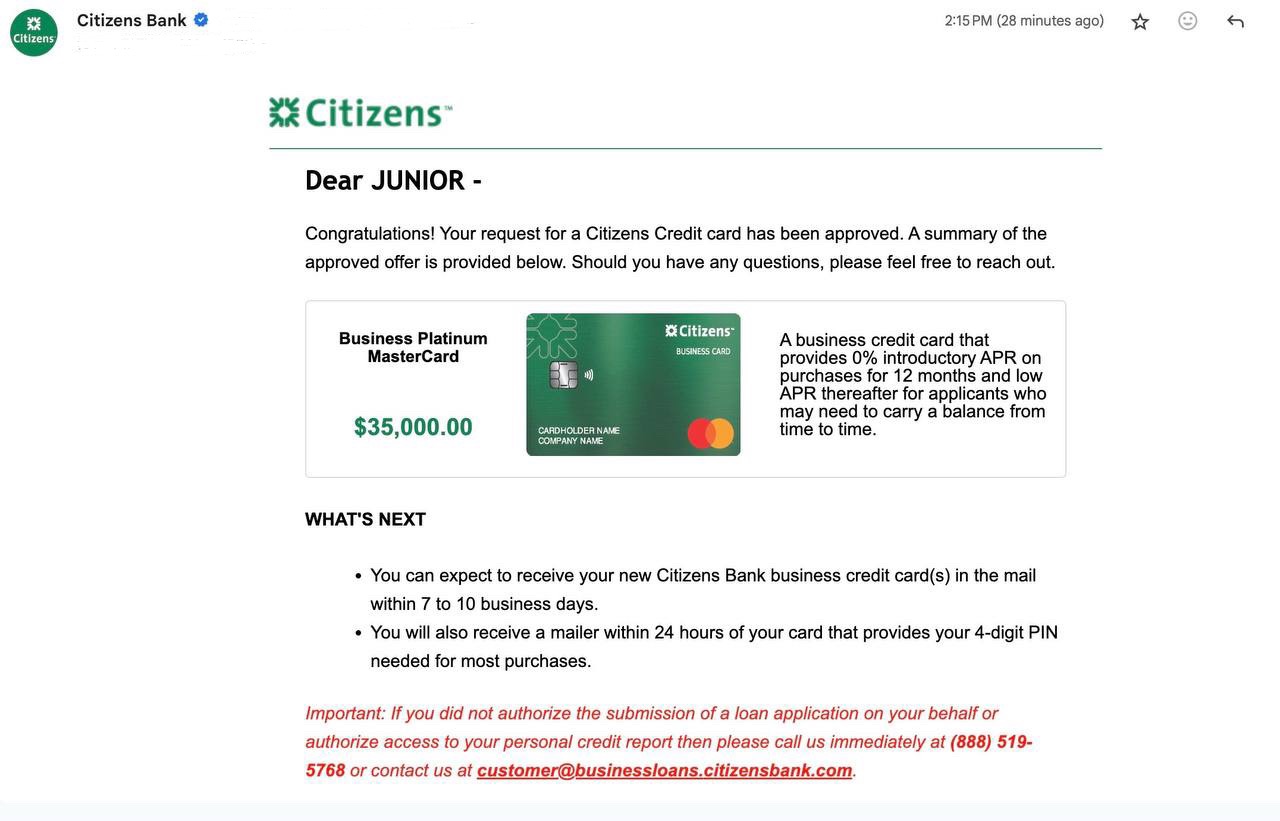

Business Funding Approvals

PROCESS

Business Funding Principles

Learn the core principles that every lender looks for before issuing capital.

You’ll build a strong foundation — from business structure to address setup and compliance — so your business becomes instantly credible in the eyes of banks and underwriters.

Personal Credit Profile Build out

Understand how personal credit influences your ability to secure business funding and learn how to properly position your profile for maximum approvals — without damaging your score or over-leveraging your personal credit.

Fine Details & Management

Discover the exact order to follow when applying for funding — from establishing compliance to building early vendor relationships — so you never waste time or get denied for missing simple details.

Business Credit Build Out

Learn how to build strong business credit step-by-step, the right way.

You’ll uncover how to create vendor, retail, and revolving accounts that actually report and grow your company’s funding power.

Access To A Private Community

Join a network of ambitious entrepreneurs who are actively building fundable businesses.

Ask questions, share wins, and get insider updates on new lenders, compliance changes, and credit-building opportunities.

AI Funding System Demo

Get a free demo of the AI business funding system. I'll show you what it offers and you'll also get free access.

Testimonials

See How Entrepreneurs were able to gain access to business funding.

WHY YOU NEED THIS

Transform From Being Denied Funding To Fully Funded

Missing compliance items

Weak business credit foundation

No banking relationship or comparable credit

No clue what lenders actually look for

You’ll know what banks, lenders, and underwriters see.

You’ll get tailored next steps to qualify for higher funding.

You’ll save months of trial and error and thousands in denials.

4.9/5 star reviews from 3k+ Entrepreneurs

Meet Your Instructor

Aron Stewart

Business Credit Specialist

Aron Stewart is a visionary entrepreneur and business funding coach committed to helping individuals build fundable businesses and achieve financial independence. As the founder of We Maneuver LLC and creator of The Business Funding Blueprint, Aron has helped countless entrepreneurs access $50K–$250K in capital to launch, scale, and sustain their businesses.

Driven by a mission to bridge the gap between ambition and opportunity, Aron teaches proven strategies that show entrepreneurs how to structure their business correctly, establish credibility with lenders, and secure funding without relying on personal credit. His step-by-step systems have empowered clients to turn struggling startups into thriving, well-funded enterprises.

Aron’s coaching philosophy is rooted in integrity, discipline, and results. He believes true success comes from understanding how money and credit work — and using that knowledge to create long-term freedom. Through his workshops, digital courses, and one-on-one mentorship, Aron continues to transform everyday business owners into financially independent CEOs.

More than a coach, Aron is a leader dedicated to helping others win. His passion for entrepreneurship and financial literacy fuels his mission to help people take control of their future, gain access to capital, and build the life they deserve.

Ready to take your business to the next level?

Join Aron Stewart and discover how to structure, fund, and scale your business using The Business Funding Blueprint.

THE OFFER BREAKDOWN

THE COMPLETE BUSINESS FUNDING BLUEPRINT MASTERCLASS

Everything You Need to Build, Structure & Fund Your Business Like a Pro

Instructed By A Certified Professional ($2997 Value)

Personal Credit Profile Build Out ($497 Value)

Business Credit Profile Build Out ($297 Value)

Access to Private Funding Community ($197 Value)

$250K+ Business Funding Sequence ($1,997 Value)

AI Business Funding Demo ($997 Value)

TOTAL VALUE: 6,982

Today Only: $27 One-Time

STILL NOT SURE?

Our $50,000 Funding Confidence Guarantee

We’re so confident in the power of the Business Funding Blueprint Masterclass that if you follow our proven process and don’t get approved for at least $50,000 in business funding offers, we’ll give you 100% of your money back.

No complicated rules. No hoops to jump through.

Just show that you implemented the steps — and if the system doesn’t produce real funding opportunities, you don’t pay a penny.

We take the risk — you get the reward.

That’s how much we believe in the results this system delivers.

WHY WE'RE DOING THIS

Why I’m Offering This Complete Masterclass for Just $27

Three years ago, I was exactly where you are — frustrated, denied for funding, and tired of hearing “no” from banks and lenders. I remember staring at a $10,000 consultant quote and wondering why no one was teaching entrepreneurs how to actually become fundable.

So, I created my own process.

Using this system, I secured over $250K in business funding — all without relying on personal credit or expensive advisors.

After refining and testing this process with over 500 entrepreneurs, I realized something important:

No business owner should have to choose between accessing capital and protecting their financial future.

That’s why I decided to make this entire program — the full training, the funding tools, and the step-by-step guidance — available for just $27.

Because access to funding shouldn’t cost you thousands in consulting fees. It should empower you to grow, scale, and finally take control of your business finances.

WHO IS THIS FOR

This System Works For Every Entrepreneur Ready To Access Funding

New Business Owners

Time-Strapped Professionals

E-Commerce & Product Brands

Detail-Oriented Entrepreneurs

Growing Entrepreneurs

Strategic Thinkers

Hands-On Decision Makers

Action-Takers

Credit-Building Founders

Financially Savvy Builders

Startups Needing Capital

Compliance-Focused Owners

TIME IS OF THE ESSENCE

The Longer You Wait, The More Money You’re Losing in Missed Funding Opportunities

Every day you delay getting funding-ready, you’re missing out on potential approvals, lender relationships, and growth opportunities.

While you wait, other entrepreneurs are securing $50K–$250K in capital — using the same system that could be working for you right now.

Our research shows that entrepreneurs who start building business credit early gain access to funding 3x faster and save thousands in high-interest rates and rejections.

And right now, you can get the complete Business Funding Blueprint Masterclass — including all tools and expert guidance — for just $27 (less than the cost of a single consultant call).

This special price won’t last long — and enrollment closes once capacity is reached.

Lock in your access today and start building a business lenders can’t say no to.

STILL GOT QUESTIONS?

Frequently Asked Questions

What if I already have an LLC?

Perfect — you’ll learn how to make it lender-compliant and funding-ready.

How soon can I get results?

Most users see progress within 2–4 weeks after completing their initial system steps.

Will this help a brand-new business?

Yes — it’s designed to guide you from formation to funding readiness.

Do I need good personal credit?

No — In this course I also teach ways how to get funded building strictly business credit only. If you have great personal credit, I have a section about how to get funded that way as well.

Can I get help if I get stuck?

Absolutely! You get unlimited email access to our expert business credit support team. Ask questions, get feedback, and receive personalized guidance whenever you need it.

Copyrights 2025 | We Maneuver LLC™ | Terms & Conditions